hapabapa

Dutch Bros (NYSE:BROS) is a rapidly growing coffee chain headquartered in Grants Pass, Oregon. Founded in 1992 by brothers Travis and Dane Boersma, the company operates a unique drive-thru model that focuses on providing high-quality coffee, beverages, and customer service. Dutch Bros is known for its loyal customer base, energetic staff, and commitment to community involvement.

BROS has a strong commercial standing in our view. It has exploited gaps in the market, alongside replicating key attractive qualities of its peers to develop a compelling offering. The company’s revenue growth and consumer engagement reflect how well it is resonating with the public.

Whilst the business will continue to face issues funding its expansion, greater scale and growing interest will only soften the issues with this. The company’s EBITDA margin is only 2ppts below its peer group average, while its FCF margin should fall below -5% by FY26F. So long as it can navigate the coming 2 years, growth funding should no longer be an issue. For this reason, the more important factor is whether there is demand to meet growth, which appears to be the case.

BROS stock is currently trading at 19x its NTM EBITDA, while its peers are trading at 19x LTM EBITDA. This closing delta represents funding downside risk and the risks associated with its growth story. Whilst these are plausible, we believe the strength of its growth trajectory will be sufficient to allow for multiples contraction.

We may be early due to additional funding requirements but we initiate at a buy rating.

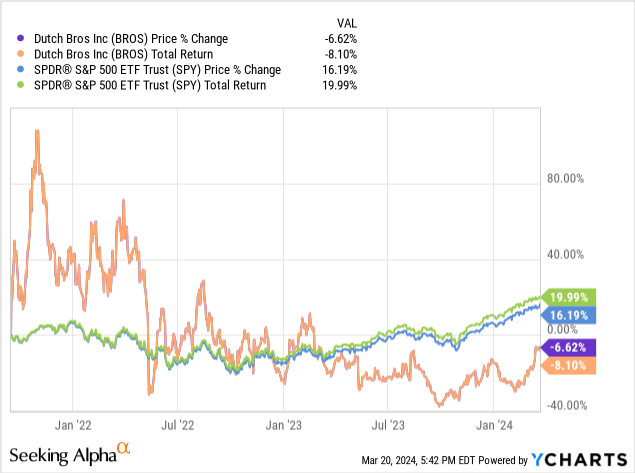

Data by YCharts

Data by YCharts

BROS’ share price has struggled since the stock was listed, albeit coinciding with difficult economic conditions. Investors are hesitant about the long-term trajectory of the business and the weaknesses in its growth story.

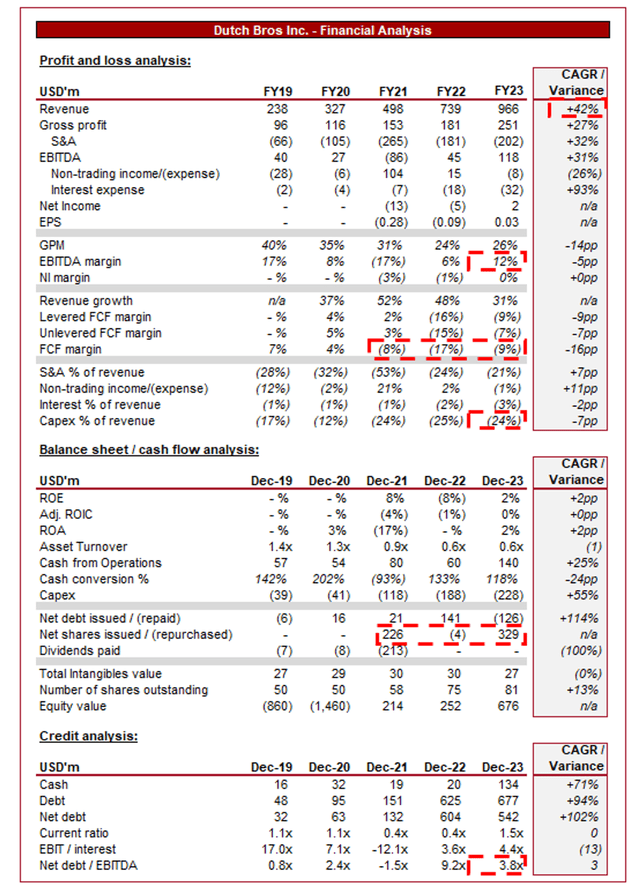

Capital IQ

Presented above are BROS’ financial results.

BROS’ revenue has grown impressive since FY19, with a CAGR of +42%. Despite this, margin development has been inconsistent, as Management has remained focused on growth.

Business model and commercial profile

BROS operates a chain of drive-thru coffee stands that specialize in serving high-quality coffee and beverages to customers on the go. The drive-thru format offers convenience and efficiency, while ensuring consumers are not compromising on quality.

This is the key difference between BROS and the existing market dynamics, where consumers need to choose either quality, through visiting a coffee shop or convenience, through such locations as C-stores. This gap in the market, which we concede is not empty (Starbucks does offer some drive-thru locations for example), has allowed BROS to gain market share quickly and expand its brand.

The company’s coffee is generally well regarded and favored for its flavor, which gives the perception of quality. This aligns with the growing consumer preference for specialty coffee and artisanal beverages, as innovation in the industry has drawn interest beyond the “standard” options.

BROS competes with other coffee chains such as Starbucks (SBUX), Dunkin', and Peet's Coffee, as well as local and regional coffee shops in its operating markets. Whilst BROS clearly does not have the best coffee on the market, we do not believe that is necessarily the requirement. The company must be comparable to its higher-quality peers with similar choices, which is the case, and can then rely on its convenience and other factors (discussed subsequently).

Underpinning the offering of quality and convenience, BROS has invested heavily in its experience. The company places a strong emphasis on creating a positive and personalized customer experience. BROS cultivates a unique employee culture centered around positivity, teamwork, and empowerment. Baristas, known as "Broistas," undergo extensive training not only in coffee preparation but also in customer service and communication skills. Further, the company is committed to giving back to its community and engaging in philanthropic activities. Finally, while coffee is the cornerstone of BROS' offerings, the company also provides a diverse menu of specialty drinks, including smoothies, teas, energy drinks, and flavored sodas, many of which cannot be found elsewhere and have developed a cult following.

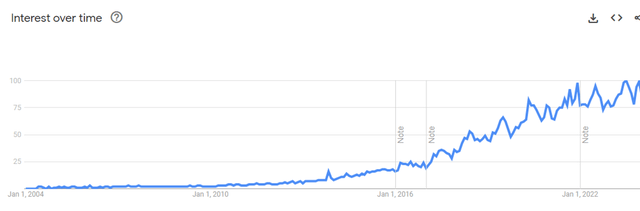

Whilst a good product and a gap in the market is important, equally important is marketing, which BROS has also succeeded in. The company has cultivated a strong and recognizable brand identity, investing heavily in “new-age” marketing through social media, namely Instagram and Facebook. As the following illustrates, interest in the BROS brand has persistently increased YoY and appears on a clear upward trajectory.

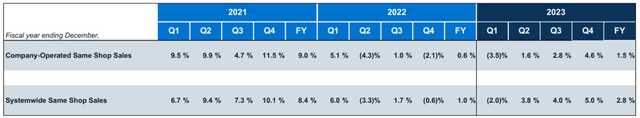

Overall, we are very impressed by BROS’ competitive position. It is foundationally based on a consumer need, namely a better combination of flavor/quality and convenience. Built on this is the development of products and services to lean into what consumers are looking for, be it other enjoyable products or a pleasant in-store experience. The evidence of this success is reflected below we feel, which shows persistent same-store growth (this eliminates any effect from location volume which top-line growth reflects).

BROS

Strategy and forward period

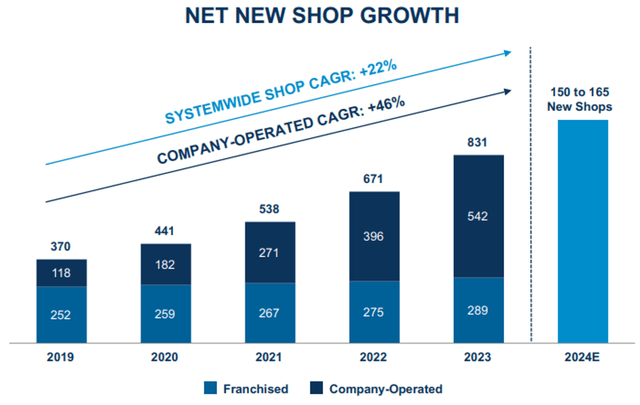

BROS’ strategy for growth has shifted from a franchise approach to company ownership. As the below graph illustrates, growth in company-operated locations has grown at a CAGR of +46% since 2019, while systemwide shops have grown +22%. This approach is generally slower and more risky, requiring self-financing and the burden of the responsibility of operations (staff, maintenance, etc.), however, comes with the upside of cutting out franchisees.

Our default view is that franchising is superior in the Restaurant industry, albeit with a very clear exception. Where a brand is developing for global dominance and Management is genuinely taking a long-term view, having maximum control can only be net beneficial (rather than risking dilution of quality through franchising). This is why we are supportive of Chipotle’s (CMG) lack of franchising. At a far later date once the brand is mature, a process can begin to franchise existing locations.

This does not come without concern, however. In order to maintain its current trajectory and potentially accelerate it, BROS requires significant capital. Capex currently comprises ~24% of revenue, with its FCF margin at -9%. This is likely a bottleneck for the company, as BROS has required funding from shareholders through issuances given its ND/EBITDA ratio is 3.8x. The worry is that BROS would expand faster if it could (Management targeting >4,000 locations) but likely will need to decelerate if investor appetite softens.

BROS

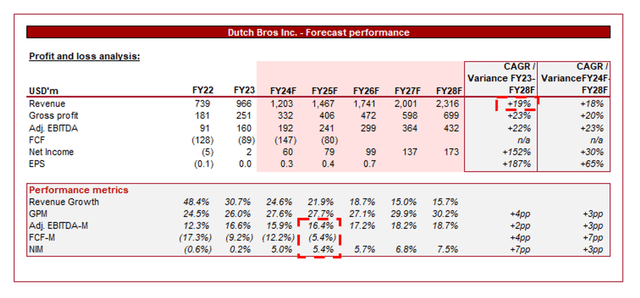

Looking ahead, analysts are forecasting strong growth in the coming years, with a CAGR of +19% into FY28F. Alongside this, margins are expected to sequentially improve, albeit with negative FCF as growth is funded.

Capital IQ

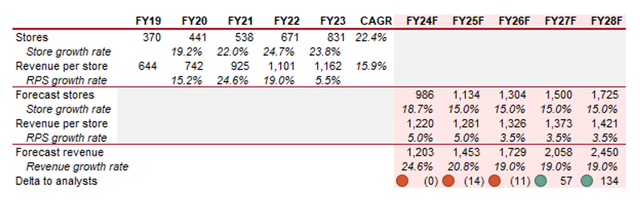

Whilst these forecasts appear bullish, we believe they are actually conservative. Although we do not have the sub-components of this forecast, we can estimate that analysts expect store growth to fall below a CAGR of +15% and a revenue per store growth rate to below +5%. This compares to a CAGR of +22% and +15.9% between FY19 and FY23.

We believe the company can deliver the following, which suggests store growth of ~15% and revenue per store growth of +5%, falling to +3.5% in later years. This lands at a CAGR of +20%.

Author's own calculations / Capital IQ

Balance sheet consideration

As touched on previously, BROS’ balance sheet likely has little room for further debt, requiring share issuances to raise capital to fund growth. The company is unlikely to reach FCF positivity in the coming 3 years, unless it significantly slows its expansion, which would be a worse outcome. For this reason, a major threat to any bull thesis is the ability to raise cash and further streamline its start-up costs.

Seeking Alpha

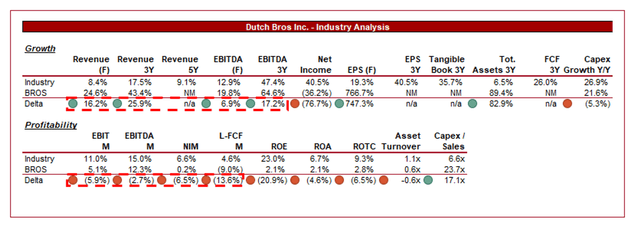

Presented above is a comparison of BROS’ growth and profitability to the average of its industry, as defined by Seeking Alpha (37 companies).

BROS is currently significantly outgrowing its peers, as we would expect, reflecting its market share growth and compelling offering to consumers. Importantly for us, the company’s EBITDA-M is rapidly approaching its peers’ average, which implies a mature level could be above-average.

Capital IQ

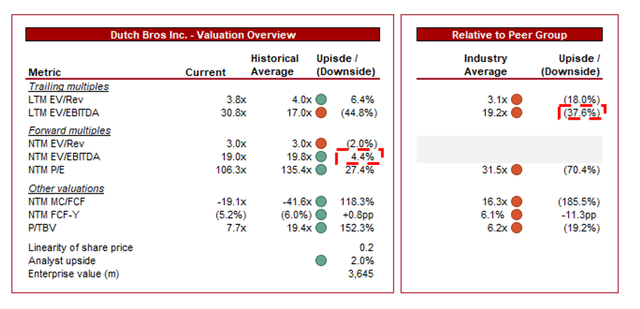

BROS is currently trading at 31x LTM EBITDA and 19x NTM EBITDA. This is a discount to its historical average on a NTM basis.

BROS is currently trading at a similar valuation to its peers when considering its NTM EBITDA multiple. This, we believe, reflects investor hesitance around the ability to sustain growth and maintain interest in its brand. These are completely valid reservations and a major risk to the bull thesis. This said, even if growth falls below forecasts, BROS’ lower growth rate and small margin improvement alone will quickly bring the business into a discount territory. Further, the company can, theoretically (we do not actually suggest this), “turn the taps off” on capex, allowing for FCF generation.

For this reason, we believe the fundamental question should wholly be whether BROS has staying power within the industry. Through our analysis of its commercial position, we believe so. Through an analysis of a number of reviews, we regularly see BROS within the top 10 for chains and the US is large enough for this footprint. The company is unlikely to reach the position of Starbucks, at least based on existing evidence and trajectory, yet the market is clearly large enough for multiple players.

The risks to our current thesis are:

BROS is a solid business in our view. The company has looked at the dynamics within the industry and positioned its offering to exploit deficiencies to much success. With a growth rate of +42% since FY19, BROS clearly has strong traction and a growing share of wallet spend.

We expect the company to broadly maintain its trajectory, albeit with a natural step-down with scale. Given BROS is operating at a high for interest, there is certainly risk with maintaining brand development. Further, we see considerable risk in funding its expansion, which needs to be maintained in order to add fuel to its fire. We believe these risks are softened by its current valuation.

Given the comparable valuation on a NTM basis and strong commercial development, we rate BROS stock a buy.